vermont sales tax food

As a Streamlined Sales Tax state Vermont encourages out-of-state sellers without a sales tax obligation to register with the state and collect. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants.

Publications Department Of Taxes

Fast Easy Tax Solutions.

. To determine tax due multiply the sale amount by 9 or 10 if the sale is subject to local option tax and round up to the nearest whole cent according to the following rules. If the alcohol is being delivered the delivery fee is part of the meal price and is also taxable. What is food tax in Vermont.

If you must pay sales and use tax for multiple locations or if your total sales and use tax remitted for the year will exceed 100000 the Commissioner of Taxes has mandated that you use myVTax. Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate. You can lookup Vermont city and county sales tax rates here.

The transfer of taxable tangible goods and services is subject to Vermont sales tax. If you have a single location and cannot file and pay through myVTax you may still use the paper forms. A restaurant adds a standard 22 service charge to all taxable meal charges for parties of eight or more.

In most states necessities such as groceries clothes and drugs are exempted from the sales tax or charged at a lower sales tax rate. Currently combined sales tax rates in Vermont range from 6 to 7 depending. Sales Tax Exemptions in Vermont.

For further guidance on beverages that. Even if the full amount is distributed to service employees 2 of the service charge is subject to tax because the service charge is not left voluntarily by the customer and exceeds 20. The latest sales tax rates for cities starting with A in Vermont VT state.

Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA.

To learn more see a full list of taxable and tax-exempt items in Vermont. Learn more about Vermont Sales and Use Tax. While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

What is the local sales tax rate in Vermont. A recent bureaucratic report recommends expanding Vermonts sales tax to include food groceries electricity and clothing to. This page discusses various sales tax exemptions in Vermont.

974113 with the exception of soft drinks. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Vermont VT Sales Tax Rates by City A The state sales tax rate in Vermont is 6000.

The Dover Sales Tax is collected by the merchant on all qualifying sales made within Dover. Sales tax and use tax work together to create the same tax result whether a seller collects sales tax or not. This means that an individual in the state of Vermont purchases school supplies and books for their children.

Soft drinks subject to the Vermont Meals and Rooms Tax. This page describes the taxability of clothing in Vermont. File Form SUT-451 Sales and Use Tax Return.

Groceries and clothing are exempt from the Dover and Vermont state sales taxes. The Alcoholic Beverage Tax is 10. Dover collects a 1 local sales tax.

970131 and 54. In the state of Vermont sales tax is legally required to be collected from all tangible physical products being sold to a consumer. While the Vermont sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation.

Food Food Products and Beverages Exempt Food food products and beverages are exempt from Vermont Sales and Use Tax under Vermont law 32 VSA. Ad Find Out Sales Tax Rates For Free. The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax.

974113 with the exception. A state sales tax of 9 is imposed on prepared foods restaurant meals and lodging and 10 on alcoholic beverages served in restaurants. The Vermont Meals and Rooms Tax is 9.

Prepared Food is subject to special sales tax rates under Vermont law. Tax computation must be carried to the third decimal place and. Soft drinks sold in vending machines and as part of a taxable meal such.

Use tax has the same rate rules and exemptions as sales tax. Are groceries taxed in Vermont. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. 2020 rates included for use while preparing your income tax deduction. The Vermont state sales tax rate is 6 and the average VT sales tax after local surtaxes is 614.

The 10-percent tax also applies to alcohol served for immediate consumption. Soft drinks are subject to Vermont tax under 32 VSA. What is sales tax on food in Vermont.

With local taxes the total sales tax rate is between 6000. 974113 with the exception of soft. The Dover Vermont sales tax is 700 consisting of 600 Vermont state sales tax and 100 Dover local sales taxesThe local sales tax consists of a 100 city sales tax.

Rates include state county and city taxes. Are groceries taxed in Vermont. Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6.

9741 13 with the exception of soft drinks. Municipal governments in Vermont are also allowed to collect a local-option sales tax that ranges from 0 to 1 across the state with an average local tax of 0156 for a total of 6156 when combined with the state sales tax. An example of items that are exempt from Vermont sales tax are items specifically purchased for resale.

This page describes the taxability of food and meals in Vermont including catering and grocery food. Sales of prewritten computer software have been subject to sales tax in Vermont since July 1 2014. 9701 31 and 54.

To learn more see a full list of taxable and tax-exempt items in Vermont. Remote sellers and marketplace facilitators must collect Vermonts sales tax on retail sales into the state if their gross receipts for the previous. FOOD FOOD PRODUCTS AND BEVERAGES - TAXABLE.

Effective July 1 2015 soft drinks are subject to Vermont tax under 32 VSA. The maximum local tax rate allowed by Vermont law is 1.

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Bun Baker Cookstove Baker S Oven Tiny Wood Stove Wood Stove Cooking Wood Stove

80 Vintage Black Dominoes Ornate Gaming Display Domino Black Dominoes Vintage Black Vintage

Publications Department Of Taxes

Impending Adult Use Marijuana Program Will Test Made In Vermont Ethos

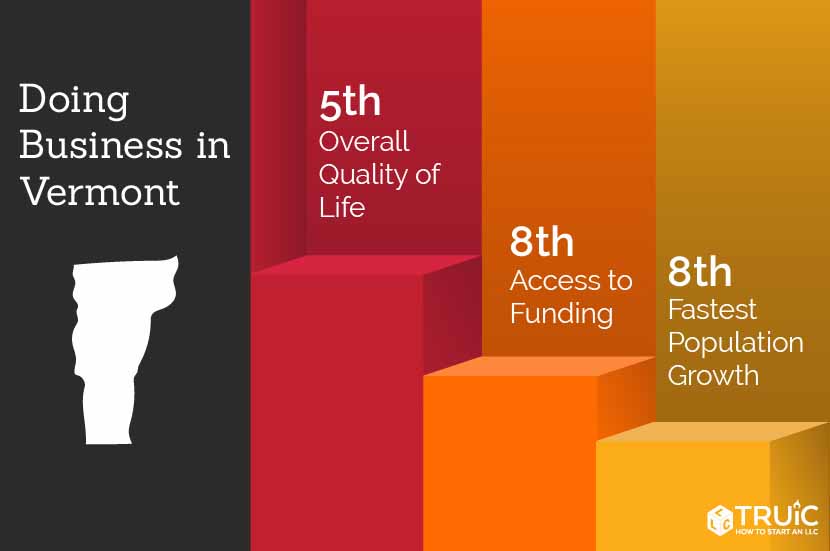

How To Start A Business In Vermont A How To Start An Llc Small Business Guide

In Pandemic One Vermont Ski Town Found An Economic Growth Catalyst

Home Of The Best Mustard Ever Stowe Mercantile New England

80 Vintage Black Dominoes Ornate Gaming Display Domino Black Dominoes Vintage Black Vintage

Vermont Sales Tax Small Business Guide Truic

Sound Money Index Gold Silver Laws In 2020 Money Index Sound

Experts Weigh In On Inflation Interest Rates The Economy Vermont Business Magazine

Is Clothing Taxable In Vermont Taxjar

Exemptions From The Vermont Sales Tax

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation